Iowa Bankruptcy FAQ

Iowa Bankruptcy Frequently Asked Questions

Here is a collection of most frequently asked questions from my 40+ years of Iowa Bankruptcy.

How much does a bankruptcy cost ?

My fees for a typical consumer bankruptcy are $2500. In addition, the court costs payable to the Clerk of Court are $400.

Are there any exceptions ?

Unfortunately no. If an attorney does a bankruptcy on credit, the attorney must disclose the payment arrangement and discharge his bill in the bankruptcy. The debtor must then get another attorney as the original attorney cannot be an attorney for the debtor and a creditor at the same time.

Why are Bankruptcy fees so high?

The 2006 Bankruptcy reform act made the bankruptcy lawyers for the debtor personally responsible for the accuracy and truthfulness of the schedules. This requirement added a lot of time and work to a bankruptcy compared to what was required before under the 1978 bankruptcy act.

How long does the Bankruptcy take ?

Usually about 90 days once the petition is filed with the Clerk. The creditor collection efforts must stop immediately when the petition is filed.

Are all the Bankruptcy fees due at once ?

The first appointment is no charge. Once you decide to proceed with the Bankruptcy, the fees are due when the work session [2nd appointment] occurs.

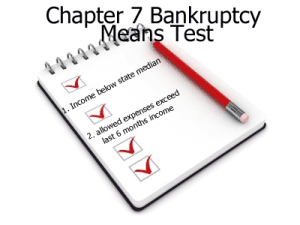

How much debt is needed for a Bankruptcy ?

There is no set amount needed for a Bankruptcy filing. Generally, I advise people that if they have unsecured debts of more than six months net income, they should file. However, every situation is different. That’s why you need to check and contact bankruptcy lawyers to advise you properly.

What do I need to get together for a bankruptcy ?

- LAST TWO YEARS TAX RETURNS

- LAST BANK STATEMENTS FOR EVERY BANK ACCOUNT

- LAST PAY STUB FROM WORK.

- List of creditors with addresses if possible

- Certificate of counseling [ I will need it before filing]

- Attorney fee of $2500 and Court costs of $400.

Does my spouse have to file also?

No, the spouse does not have to file. It complicates the schedules but you can file as a married person filing singularly.

Qualified Bankruptcy Attorney

Over 1000 completed Iowa Bankruptcy cases!

Over 40 Years of Experience

Since 1974 I've been helping people get their lives back on track!

A different approach

I handle my Bankruptcy cases differently from the high volume bankruptcy firms. I meet with you personally every time.

Call Us During Business Hours

8am To 4pm: Monday, Tuesday, Thursday And Friday

8am To 12pm: Wednesday

After Hours

I'm here to Help

Bankruptcy is not a topic people want to talk about or consider often.

The stress leading up to bankruptcy can often be overwhelming and difficult to manage. Many people struggle with the emotional toll of being in a lot of debt. Luckily, you’re not alone and bankruptcy is a great way to get relief after difficult times.